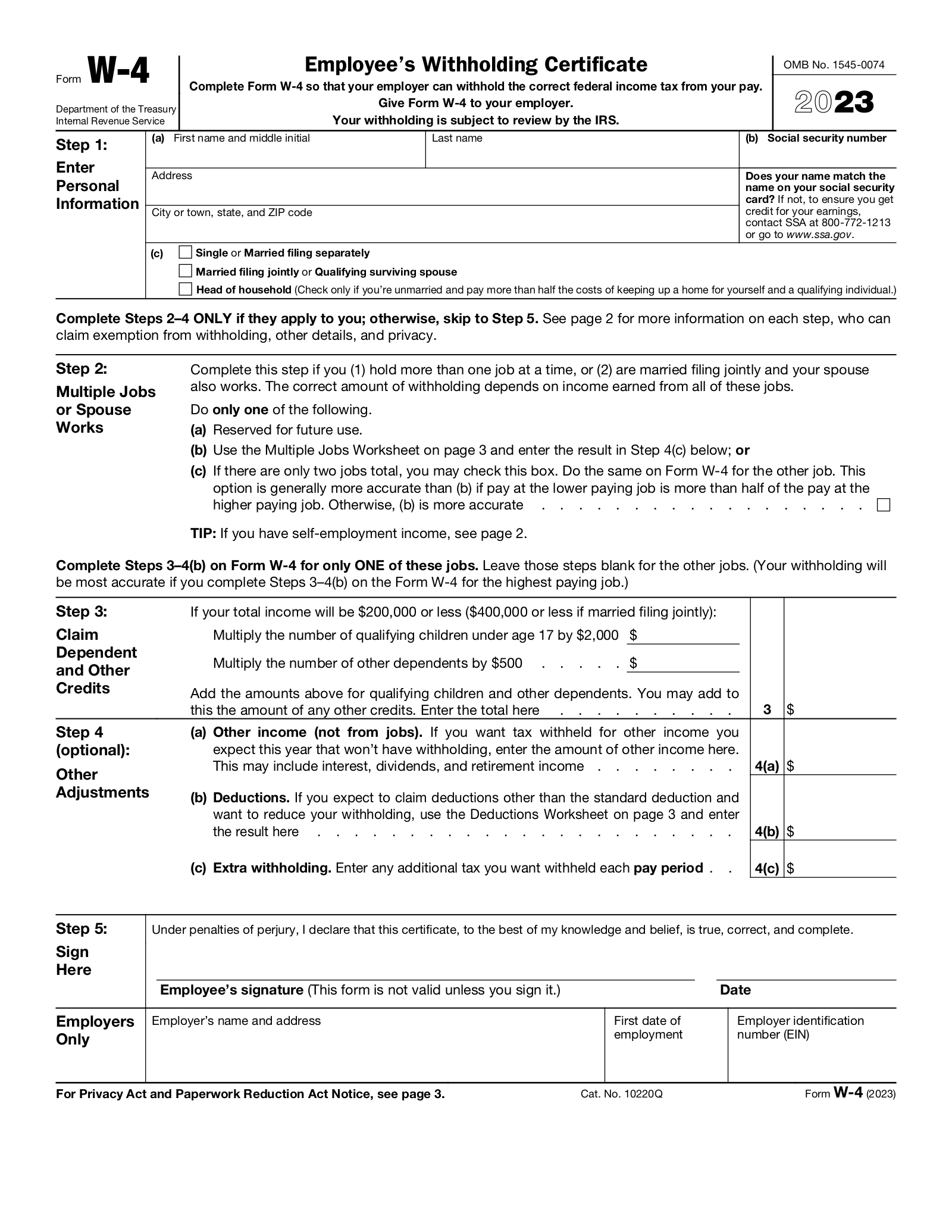

Irs Website W4 2024 – Don’t be alarmed, on average US tax refunds are 13% lower this year. Here are ways you can receive a bigger one. . As of 2024, employers and employees each pay 6.2% for Social taxes properly based on how much the employee makes and how they fill out their W-4 form. State payroll tax rates vary. However, the .

Irs Website W4 2024

Source : www.irs.govPublication 505 (2023), Tax Withholding and Estimated Tax

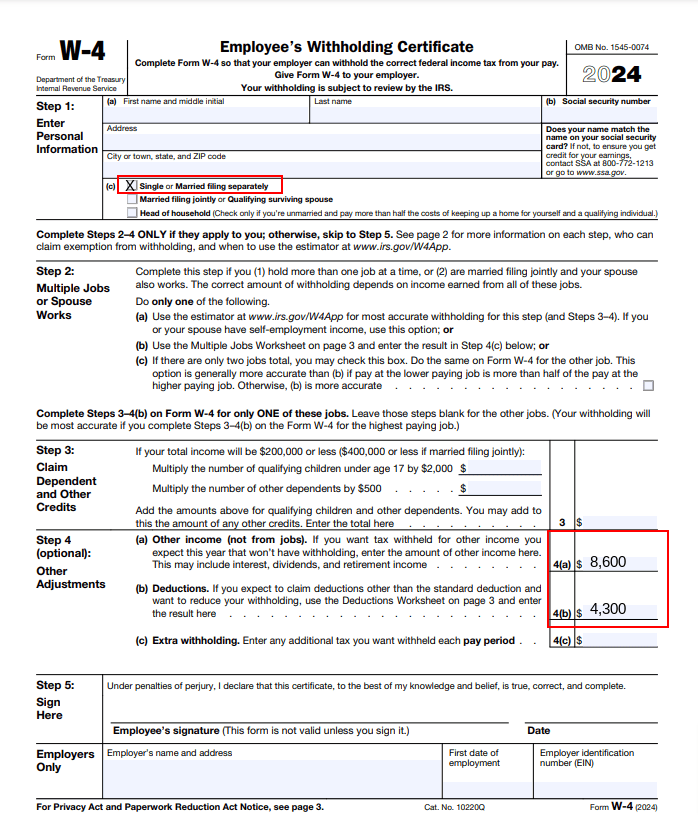

Source : www.irs.gov2024 Form W 4P

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comWhat Is the W4 Form and How Do You Fill It Out? Simple Guide

Source : smartasset.comFree IRS Form W4 (2024) PDF – eForms

Source : eforms.comW4 IRS tax Form W 4 How to fill out IRS Tax form with

Source : m.youtube.com2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comHow To Fill Out an IRS W 4 Tax Form in 2024 | Indeed.com

Source : www.indeed.comIrs Website W4 2024 Employee’s Withholding Certificate: Looking for a way to file your tax return for free this tax season? The IRS is doing a small-scale test of its Direct File tax-filing program, which could soon be available broadly to millions of US . You can check your federal tax refund status through the ” Where’s My Refund? ” tool on the Internal Revenue Service’s website. Visit irs.gov/refunds or use the IRS2Go mobile app to see the latest .

]]>